Affordable Housing Strategy

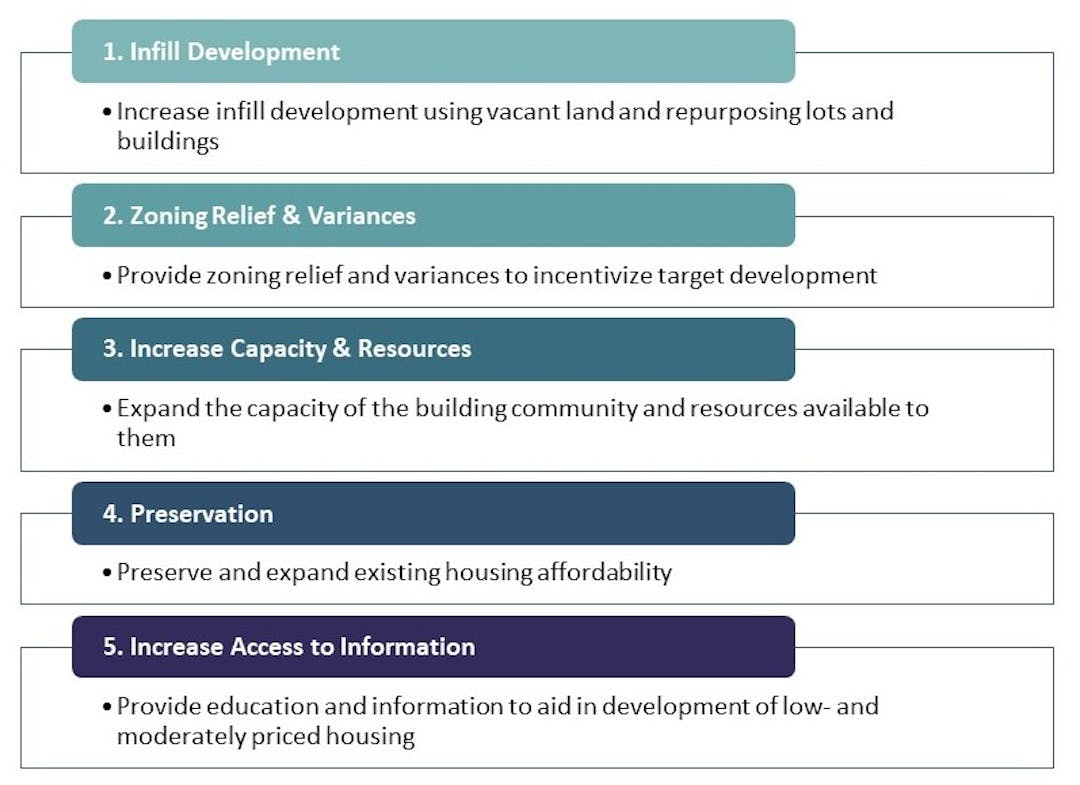

City Council adopted Denton’s Affordable Housing Strategic Toolkit on February 15, 2022 (ID 22-090). The toolkit outlines five recommended strategies with targeted activities to deliver housing interventions.

Community Services and City Council are working to develop and implement the targeted activities within the toolkit. To stay up to date on our progress, sign up for our newsletter and register through the right-hand menu for information, programs, and to get involved.

City Council adopted Denton’s Affordable Housing Strategic Toolkit on February 15, 2022 (ID 22-090). The toolkit outlines five recommended strategies with targeted activities to deliver housing interventions.

Community Services and City Council are working to develop and implement the targeted activities within the toolkit. To stay up to date on our progress, sign up for our newsletter and register through the right-hand menu for information, programs, and to get involved.

-

Homelessness is a Housing Problem: Dr. Gregg Colburn and Joint Center for Housing Studies of Harvard University

Share Homelessness is a Housing Problem: Dr. Gregg Colburn and Joint Center for Housing Studies of Harvard University on Facebook Share Homelessness is a Housing Problem: Dr. Gregg Colburn and Joint Center for Housing Studies of Harvard University on Twitter Share Homelessness is a Housing Problem: Dr. Gregg Colburn and Joint Center for Housing Studies of Harvard University on Linkedin Email Homelessness is a Housing Problem: Dr. Gregg Colburn and Joint Center for Housing Studies of Harvard University linkIn this webinar Dr. Gregg Colburn reviews his recent study and subsequent book of cities across America, investigating why some cities have greater rates of homelessness per capita than others. His research highlights one reason why the City of Denton chooses to prioritize affordable housing.

-

JCHS: Low-Cost Rentals Have Decreased in Every State

Share JCHS: Low-Cost Rentals Have Decreased in Every State on Facebook Share JCHS: Low-Cost Rentals Have Decreased in Every State on Twitter Share JCHS: Low-Cost Rentals Have Decreased in Every State on Linkedin Email JCHS: Low-Cost Rentals Have Decreased in Every State linkFrom the Joint Center for Housing Studies (JCHS):

"The supply of low-cost rentals fell by 3.9 million units over the last decade, according to our latest State of the Nation’s Housing report. As a new interactive tool released in conjunction with the report shows, the supply of low-cost rentals decreased in every single state, leaving lower- and middle-income renters with even fewer housing options they can afford."

The article can be viewed here, where research analyst Sophia Wedeen dives into the history and potential causes of this decrease. Wedeen additionally takes a deep dive into a few states, including Texas, California, and Ohio.

The JCHS 2023 State of the Nation's Housing report is available here and includes state level information on home price growth, supply of low-cost rentals, renter cost burdens, and more.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

Low-Income Housing Tax Credit

Share Low-Income Housing Tax Credit on Facebook Share Low-Income Housing Tax Credit on Twitter Share Low-Income Housing Tax Credit on Linkedin Email Low-Income Housing Tax Credit linkThe Housing Tax Credit (HTC) program is funded by the U.S. Treasury Department and is overseen by the Internal Revenue Service. Federal Regulations guiding the program can be found in IRC Code Section 42. In Texas these funds are administered by the Texas Department of Housing and Community Affairs (TDHCA).

TDHCA offers the Housing Tax Credit program as one of the primary means of directing private capital toward the development and preservation of affordable rental housing for low-income households. The program is governed by the Qualified Allocation Plan (QAP) approved annually. Each year, TDHCA issues a new QAP that sets forth baseline criteria that all low-income housing tax credit (LIHTC) applications must meet.

There are two types of Housing Tax Credit programs available: a 4% (non-competitive) and a 9% (competitive) program. Both programs have unique features and rules; however, in general, the current QAP from the TDHCA for 9% includes a scoring item that developers receive resolutions of support or no objection from the municipality in which the project is located. For the 4% program, there are threshold documents requiring that developers receive resolutions of no objection from the municipality in which the project is located.

9% HTC (Competitive)

- The 9% HTC program is highly competitive.

- The amount of tax credits available in each region is determined through the Regional Allocation Formula (“RAF”); there are separate set-asides for “at risk” and US Department of Agriculture (“USDA”) assisted developments.

- At least 10% of the allocation must be used for qualified non-profits.

- Applications are scored and ranked within their region or set-aside.

- Scoring criteria range from financial feasibility, various indicators of local support, size and quality of units, amenities and services to be provided to the tenants, economic health of the community, and more.

- Scoring reflects requirements found in state law and program rules; the program rules are known as the Qualified Action Plan (“QAP”).

4% HTC (Non-Competitive)

- 4% HTCs are awarded to developments that use tax-exempt bonds as a component of their financing.

- Applications are accepted throughout the year.

- 4% HTCs are available statewide; they are not subject to regional allocation.

The tax credits are awarded to eligible participants and provide a source of equity financing for the development of affordable housing. Investors in qualified affordable multifamily residential developments can use the HTCs as a dollar-for-dollar reduction of federal income tax liability.

The 9% tax credit tends to generate about 70% of a development’s equity while a 4% tax credit will generate about 30% of a development’s equity. Additionally, 4% tax credits are primarily for those projects seeking financing through tax-exempt private activity bonds. The Non-Competitive (4%) Housing Tax Credit program is coupled with the Multifamily Bond Program when the bonds finance at least 50% of the cost of the land and buildings in the Development. There is a limit to the amount of 9% tax credits allocated each year from the federal government therefore the demand for 9% tax credits exceeds the supply in the competitive 9% program.

The value associated with the HTCs allows housing to be leased to qualified families at below market rate rents. Typical projects include apartment complexes, rental townhomes, mixed-income and mixed-use properties, supportive housing for those with special needs, and independent living facilities for seniors.

CITY OF DENTON HTC POLICY AND APPLICATION

The Denton City Council approved a HTC policy through Resolution 18‐756 on May 8, 2018 to establish expectations and streamline the HTC request review process.

To meet the City of Denton housing and development objectives, it is the City’s policy to review projects requesting support for proposed Housing Tax Credits (HTC). Such analysis will determine if the project(s) comply with the principles and policies found in the City’s Denton 2040 Plan, the 5-Year Consolidated Plan for Housing and Community Development, as well as various other master, strategic, and redevelopment or neighborhood plans, adopted by the City of Denton.

The goal of this analysis is to (a) establish if HTC projects merit local support, and (b) prioritize HTC submissions if more than a single proposal is received during an evaluation period. Community Services serves as the City’s primary staff and point of contact for all HTC programs. Developers seeking consideration by the City of Denton for either a Resolution of Support or a Resolution of No Objection, for an HTC from TDHCA must submit a request for support using the HTC Application.

The City’s current role is to provide Resolutions of Support (ROS) or No Objection (RONO) that help developments score the necessary points to be awarded the 9% tax credits or provide the threshold documentation necessary to apply for the 4% program.

Through implementation of the Affordable Housing Toolkit, the City of Denton hopes to expand its role in providing further assistance and incentives to developments interesting in scoring in the 9% competitive credit and the 4% non-competitive credit.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

Urban Institute Researchers Visualize Zoning Reforms Near Public Transit

Share Urban Institute Researchers Visualize Zoning Reforms Near Public Transit on Facebook Share Urban Institute Researchers Visualize Zoning Reforms Near Public Transit on Twitter Share Urban Institute Researchers Visualize Zoning Reforms Near Public Transit on Linkedin Email Urban Institute Researchers Visualize Zoning Reforms Near Public Transit linkFrom the Urban Institute:

For government leaders and residents to better understand how zoning changes would look in their communities, Urban Institute researchers have developed a new visual resource that demonstrates how various zoning reforms could increase housing production - specifically near public transportation.

Using data from the Puget Sound region (Seattle) to interactively display various zoning options, such as allowing duplexes on single-family parcels or expanding the size of allowed multi-family housing construction, this resource allows users to better visualize zoning's role in the housing shortage and understand what could happen with broader zoning restrictions across the country.

This resource builds upon a large body of research (with data from the Puget Sound region) where our experts have found that while transit investments could increase housing options, much of the land near transit stations is currently zoned to limit housing. Recently, the Washington state legislature approved a police that requires most cities in the region to allow two-to-six-unit buildings in residential zoning districts near transit.

With the data-driven resource, policymakers and housing advocates can demonstrate how re-zoning areas that currently restrict development can help address the affordable housing shortage, incentivize demand for public transit, and reduce pollution.

You can access the visual resource here, or delve deeper into the underlying data and coding via the project's Github here.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

Missing Middle Housing

Share Missing Middle Housing on Facebook Share Missing Middle Housing on Twitter Share Missing Middle Housing on Linkedin Email Missing Middle Housing linkMissing middle housing is a term that has gained significant attention in recent years, particularly in urban planning and housing development circles. It refers to a range of multi-unit housing types that fall between single-family homes and large-scale multi-family apartment buildings. These housing types include duplexes, triplexes, fourplexes, townhouses, courtyard apartments, small home communities, and other compact and diverse forms of housing.

The term "missing middle" is derived from the observation that many cities and suburbs lack this type of housing, resulting in a gap in the housing market between detached single-family homes and larger apartment buildings. The absence of these housing types has created significant challenges for many urban and suburban communities, including housing affordability, neighborhood diversity, and environmental sustainability.

In contrast to large apartment buildings, missing middle housing is typically characterized by smaller and more flexible units that are designed to be more affordable and accessible to a broader range of residents. These housing types are often more compatible with existing neighborhoods and can be designed to fit within a variety of contexts, from urban infill sites to suburban lots. They can also be designed to accommodate a range of household sizes and needs, from non-traditional families, to retirees, to those with mobility limitations, to students and young professionals.

One of the primary benefits of missing middle housing is its potential to increase housing affordability in cities and suburbs. By providing a greater diversity of housing options, missing middle housing can help to meet the needs of a wider range of residents, including those with lower incomes. In many cases, missing middle housing can be more affordable than larger apartment buildings or detached single-family homes, providing a crucial middle ground for households that may not be able to afford larger homes but also do not want to live in dense apartment buildings. Even in cases where missing middle housing falls in the market rate category of affordability, increasing the housing supply and infill utilization brings openings and opportunities for moderate- and low-income households by freeing up more affordable spaces.

In addition to its affordability benefits, missing middle housing can also promote environmental sustainability and help to reduce sprawl. By providing more compact and diverse housing options, missing middle housing can help to reduce the need for vehicles and promote more walkable and transit-oriented communities. It can also help to reduce the overall carbon footprint of a community by providing more efficient and sustainable housing options.

Some of the challenges surrounding implementing missing middle housing include land use, zoning regulations, and other development challenges, as well as initial capital demands, non-traditional loan requirements, and community awareness. Denton’s Affordable Housing Strategic Toolkit lays out several activities and strategies to work to mitigate these obstacles and incentivize innovative and affordable missing middle housing and infill.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

Complete our Accessory Dwelling Unit Survey

Share Complete our Accessory Dwelling Unit Survey on Facebook Share Complete our Accessory Dwelling Unit Survey on Twitter Share Complete our Accessory Dwelling Unit Survey on Linkedin Email Complete our Accessory Dwelling Unit Survey linkHave you or your company developed or attempted to develop an Accessory Dwelling Unit (ADU) within the City of Denton? We want your feedback. Let us know what worked, what didn't, and how we can make the experience more accessible under Strategy 1: Infill.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

City of Denton Homeowner Repair Assistance Program

Share City of Denton Homeowner Repair Assistance Program on Facebook Share City of Denton Homeowner Repair Assistance Program on Twitter Share City of Denton Homeowner Repair Assistance Program on Linkedin Email City of Denton Homeowner Repair Assistance Program linkThe City of Denton provides programs to assist low- and moderate-income homeowners living within the Denton city limits who cannot afford to complete minor repairs that, if left unattended, would jeopardize the health and safety of occupants.

Assistance Eligibility

Homeowners in Denton who meet yearly gross household income limits may be eligible for assistance with home repairs needed to make their home accessible, safe, sanitary, or habitable. This may include essential emergency repairs, structural accessibility modifications, repairs to some or all the home's major systems, or major repairs completed through rehabilitation or reconstruction.

Acceptable Repairs

- Accessibility

- Electrical

- HVAC Systems

- Other Major and Minor Issues

- Plumbing

- Roofing

Home Evaluation

The City of Denton will complete an evaluation of the home to determine the extent of the repair needed and if requested repair is eligible.

More Information and How to Apply

More information, detailed eligibility criteria, and how to apply can be found on the City's Homeowner Repair Assistance page.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

City of Denton Rental Repair Assistance Program

Share City of Denton Rental Repair Assistance Program on Facebook Share City of Denton Rental Repair Assistance Program on Twitter Share City of Denton Rental Repair Assistance Program on Linkedin Email City of Denton Rental Repair Assistance Program link Up to $24,500 of financial assistance per unit for rental unit repairs.

Up to $24,500 of financial assistance per unit for rental unit repairs.The City of Denton provides programs to increase affordable housing within the city of Denton. The program will assist with essential repairs, structural accessibility modifications, or repairs to major systems of recently acquired rental property. Financial assistance of up to $24,500 per unit is provided as a 5-year forgivable loan. In exchange for the repair assistance the rental property owner agrees to rent the property at an affordable rate to income eligible tenants during the term of the loan (Affordability Period).

Who is Eligible?

As an owner of rental property, you may be eligible for assistance with repairs needed to make their rental property accessible, safe, sanitary, or habitable. This may include essential emergency repairs, structural accessibility modifications, repairs to some or all the home's major systems, or major repairs completed through rehabilitation or reconstruction.

Eligible Repairs

- Electrical Systems

- Plumbing Systems

- Roof repairs or replacement

- Foundation repairs

- HVAC Systems

- Other major and minor issues

Property Evaluation

The City of Denton will complete an evaluation of the home to determine the extent of the repair needed and if the requested repair is eligible.

More Information and How to Apply

More detailed information, frequently asked questions, and How to Apply can be found on the City's Rental Repair Assistance page.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks -

Affordable Housing 101: Defining "Affordable"

Share Affordable Housing 101: Defining "Affordable" on Facebook Share Affordable Housing 101: Defining "Affordable" on Twitter Share Affordable Housing 101: Defining "Affordable" on Linkedin Email Affordable Housing 101: Defining "Affordable" linkAffordable housing is a critical issue for many people and communities across the U.S., including Denton. While the definition of affordable housing varies, it is generally understood to mean that low- to moderate- income households should not pay more than 30% of their income on housing costs, including rent and utilities.

What constitutes affordable housing?

There are different tools available for determining housing affordability. When discussing affordability in relation to the policies, programs, and advocacy under the Affordable Housing Toolkit, as well as grants and community programs under Community Services, the City of Denton strives to make our definitions uniform, accessible, and understandable by all stakeholders. Therefore, the City refers to affordability using the Department of Housing and Urban Affairs (HUD)’s defined terms.

HUD has established guidelines for determining affordability based on the Area Median Family Income (AMFI) estimates and Fair Market Rent (FMR) area definitions for each metropolitan statistical area (MSA). Denton is a part of the Dallas, TX HUD Metro MSA which contains: Collin County, TX; Dallas County, TX; Denton County, TX; Ellis County, TX; Hunt County, TX; Kaufman County, TX; and Rockwall County, TX.

HUD’s income limits for different household sizes and locations ensure that affordable housing programs are accessible to household of different sizes, incomes levels, and needs. An area’s median family income (MFI) is the midpoint of a region’s income distribution, where half of the population earns more and half earns less. Income qualified households fall in a percentage below MFI.

For the Dallas Metro MSA based on MFI the AMFI is currently set at $105,600 per year.

Source: HUD 2023 HOME Income Limits

Source: HUD 2023 HOME Income LimitsIncome categories:

- Moderate Income – Households with incomes between 80% and 120% of AMFI

- Low-income (LI) – Households with incomes between 50% and 80% of AMFI

- Very low-income (VLI) - household incomes between 30% and 50% of AMFI

- Extremely Low-Income (ELI) – Households 30% or below of AMFI

Income limits for a family of four:

- Moderate Income – $82,500 or more

- Low-income (LI) – $82,500

- Very low-income (VLI) - $51,550

- Extremely Low-Income (ELI) – $30,950

HUD defines affordable housing as housing that costs no more than 30% of a household’s income. Using the HUD data in income limits, categories, and household size, rent limits necessary to meet the 30% affordability standard can be determined.

Thank you for your contribution!

Help us reach out to more people in the community

Share this with family and friends

No thanks